Medicare Supplement Quotes

Step 1:

Answer 6 simple questions.

Step 2:

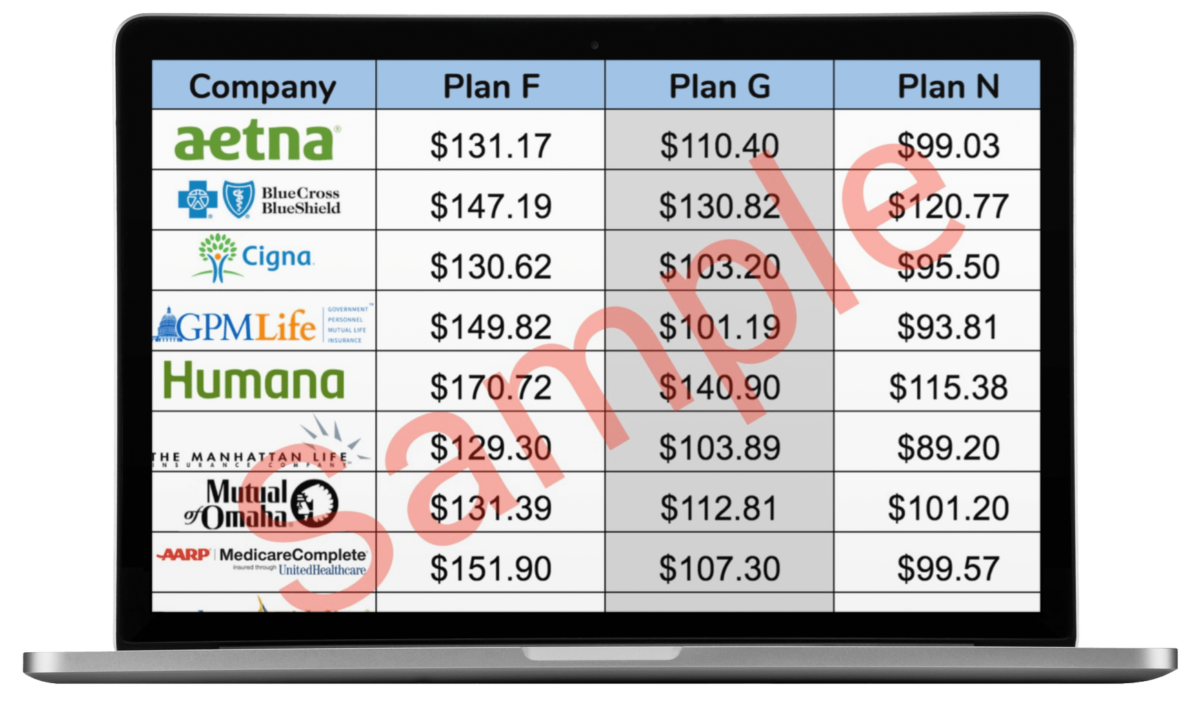

Instantly compare quotes with every major carrier.

Step 3:

Save up to 67% for the same exact Medicare Supplement coverage or better!

Independent & Unbiased

Compare Plans By:

✔︎ Price

✔︎ Deductibles & Co-Pays

✔︎ Customer Satisfaction

✔︎ Financial Stability

✔︎ Market Experience

✔︎ AM Best Ratings

✔︎ Price Increase History

New to Medicare

We were both new to Medicare and completely clueless as to how to go about comparing our Medicare Supplement options. Medicare Supplement Quotes made the process simple and easy. We were surprised to find out that Medicare Supplement plans are standardized which means there is no difference in coverage other than cost from company to company.

John & Kathy Brown - Grand Rapids, MI

I saved $76 mo. for the same coverage!

I received a rate increase with my old Medicare Supplement Plan. I was concerned I wouldn’t be able to make a change due to some health problems. Medicare Supplement Quotes was able to put me in touch with a local independent insurance advisor that did a bunch of research. He was able to get me approved with an “A” rated carrier and assisted with the entire process. What a relief!

Barb Jenkins - Toledo, OHThe A, B, C’s of Medicare

Parts A & B

(Original Medicare)

Part A = Hospital

Covers hospital stays, Home Health Care, Hospice Care

Part B = Medical

Covers Outpatient Care such as Office Visits, Lab work, Durabable Medical Equipment and Preventive Services.

Medicare Supplement

(MediGap)

Private insurance plan that covers all or some of the deductibles and coinsurance that Original Medicare (Parts A & B) charges you. These plans are standardized by letter names A-N.

Part C

(Medicare Advantage)

Medicare Advantage is an alternate way to receive your Medicare A & B benefits through a Medicare-approved private insurqnce company. Most of these plans include Medicare Part D drug coverage.

Part D

(Drug Coverage)

Prescription drug coverage provided through private Medicare-approved insurance companies.

What is Medicare Supplement (MediGap) insurance?

Medicare Supplement insurance covers all or some of the deductibles and co-insurance that original Medicare charges you. The out of pocket cost with original Medicare can be significant.

Can my application be declined due to my health?

Yes and no. If you’re within 6 months of your Medicare part B effective date your eligibility is guaranteed regardless of your health. If you are past your 6-month window and are changing plans your eligibility is based on your health. Every company has different rules for what health conditions they will accept or decline. An agent can help match you with a company based on your health conditions.

How do I apply for a Medicare Supplement plan?

We will help to find you the best plan for you and assist with the entire process. We make it easy!

Do I need a referral to see a specialist?

No. Your provider may refer you to a specailist but it’s not required for Medicare Supplement plans.

Are pre-existing conditions covered?

Yes, in most cases. If you are in your open enrollment period (within 6 months of your Medicare Part B eligibility date) pre-existing conditions are covered. Pre-existing conditions are also covered if you’re eligible for a Guarantee Issue Right, such as leaving an employer coverage within 63 days.

What's the best Medicare Supplement Plan?

The most popular plans are Plans F, G, and N. We highly recommend you speak with a licensed agent and review your health care needs so they can recommend the most suitable plan.

Will my premiums be higher if I go through an agent?

No. Premiums are the same regardless if you go through an agent or direct. The advantage of using an agent is they can shop the market and help you navigate the best options for you.

Are there networks and can I keep my doctor?

No networks. You can see any doctor or provider nationwide that accepts Medicare.

Do I have to wait until the open enrollment to enroll or change plans?

No. There is not an open enrollment period for changing Medicare Supplement plans. This is often confused with Medicare Advantage and Medicare Part D Drug plans which can only be changed during the Open Enrollment Period that runs from October 15th to December 7th.

Will my premiums increase?

Most companies have a 12-month rate guarantee. After that rates typically increase at your policy anniversary. This is another reason it’s recommended you work with an agent who can shop your rates annually to make sure you’re always getting the best deal.

Not affiliated with or endorsed by the United States government or Medicare.

© 2017 MedicareSupplementQuotes.com | Legal | Privacy